amazon flex after taxes

With Amazon Flex you work only when you want to. Learn More Make quicker progress toward your goals.

Industrial Leasing 101 Infographic

You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

. Click Choose apps 4. Hot bags courier bags. Or 12-15 in the UK.

Where you fall on that scale depends on a number of factors. For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 for 2015 SE Tax on 9235 of your net profit in addition to your regular income tax on it. Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow.

Click Manage app battery usage 3. IRS mileage rates vary by year but in 2022 the rate was 0585 per business mile. Disable the settings for Freeze when in background and Automatically optimize when an abnormality is detected Xiaomi Redmi battery device settings.

Amazon Flex will not withhold income tax or file my taxes for me. Step 2 - when you are close enough via your phones GPS and its not more than 15 minutes before the block start you can check in. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019.

Another reason tracking Amazon Flex gas costs is important is to potentially claim tax deductions. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on your car and many more expenses are considered tax deductible expenses. You will also have to pay unemployment tax on any income you make at your job.

In the app it will say arrive by and that will be a time 5 minutes after the block start eg. You expect your withholding and credits to be less than the smaller of. Click Amazon Mobile Delivery 5.

You will need to report your business income to the IRS and pay any amount that is due. The IRS lets you deduct business mileage on your tax return so you can potentially keep more of your hard-earned money when filing taxes. You can make closer to 25 per hour.

You use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. If you get a check please cash it before January 7 2022. Click the Amazon Flex app 3.

In todays video I wanted to share with you guys how to file a tax return if you are self-employed. If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail from them by late Januaryearly February of the following year the official deadline for a client to file the 1099 form is January 31st. However some people have claimed that you often will make less than this and you have to bear in mind things like petrol costs parking and general wear tear of using your vehicle.

What is Amazon Flex. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your business income. Click No restrictions and Allow access.

Get paid enjoy life repeat. Amazon claims that you can earn 18-25 per hour in the US delivering. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k.

So if you have other income like W2 income your extra business income might put you into a higher tax bracket. Arrive by 105pm for a 100pm block. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Maybe youre saving up for something big. Ad We know how valuable your time is. Amazon Flexs website states that you can make between 18 and 25 per hour during your blocks.

90 of the tax to be shown on your current years tax return or 100 of the tax shown on your prior years tax return. If your payment is 600 or more you will receive a. Go to Settings Battery 2.

As an Amazon Flex DoorDash Uber Eats Grubh.

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

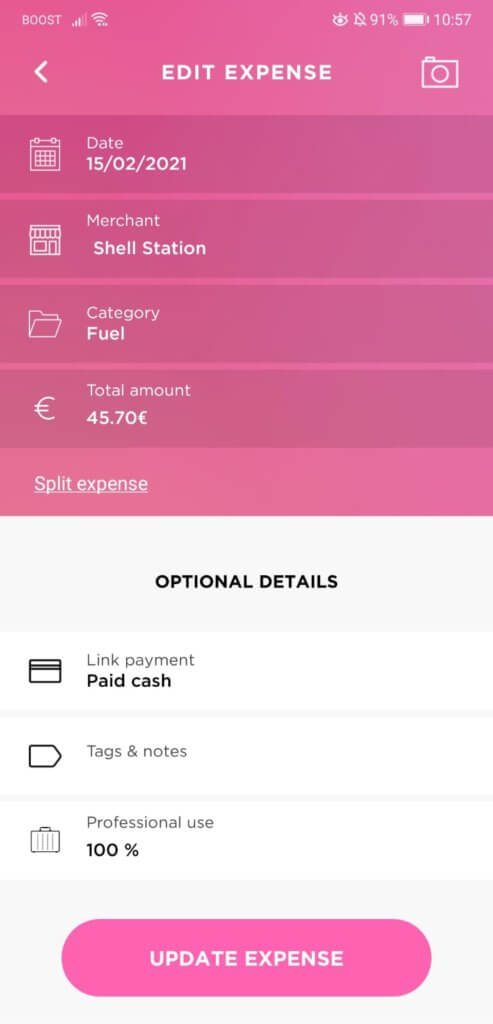

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Top 22 1099 Tax Deductions And A Free Tool To Find Your Write Offs

Amazon Sales Tax A Compliance Guide For Sellers Sellics

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Taxes Documents Checklists Essentials

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

Amazon Sales Tax Accounting Tips For Amazon Sellers

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Do Taxes For Amazon Flex Youtube

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Income Strategies How To Create A Tax Efficient Withdrawal Strategy To Generate Retirement Income William Reichenstein 9780578555089 Amazon Com Books

2021 Daily Income Mileage Toll And Taxes Tracker For Etsy In 2022 Daily Expense Tracker Rideshare Income

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable